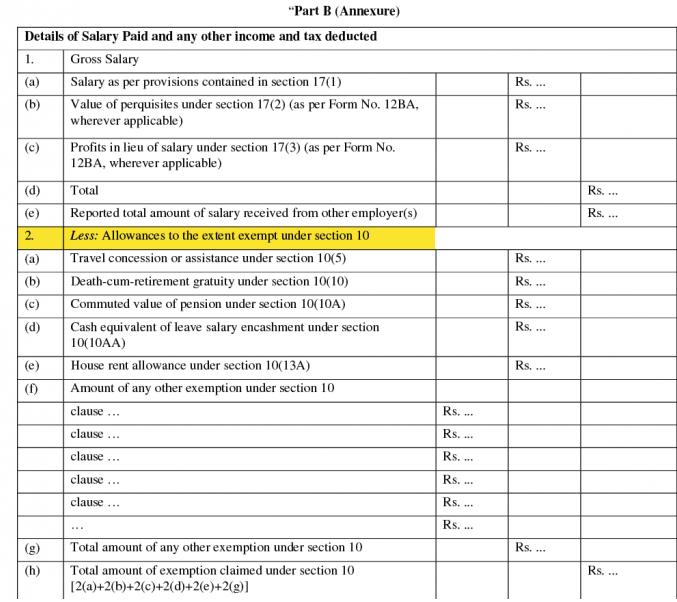

If you have any capital gain transaction then you will be required to see summary of profit or loss statement, for computation of capital gain.įor claiming tax-saving deduction under 80C, 80D, or 80G, such as donations, rent receipts, or health insurance expenditure, relevant documents need to be checked as proof of such expenditure made. In case you have received rent from any rented house property then you will require amounts of municipal taxes paid, interest on borrowed capital if any and tenant details. Form 26AS could be downloaded from the E-filing portal. You will need Form-16 issued by your employer- in case of income from salary.įorm-16A (TDS Certificate) issued by TDS Deductor.įorm-26AS to verify TDS on salary as well as TDS other than salary. What documents are required to file ITR-02?įollowing documents are required for successful filing of the ITR-2:įirst thing, you will need to check your Annual Information Statement. It should not be filed by the taxpayers who are eligible to file ITR-1. ITR 2 cannot be filed by individuals or HUFs whose income includes income or profits from business or profession in the nature of interest or salary, bonus, commission. Income includes income from a foreign country.Ī director of any company and an individual holding unlisted equity shares of a company should file their returns in ITR-2. ITR 2 can also be filed by a Non-Resident or Not Ordinary Resident. Having both short-term or long-term capital gain /losses from the sale of property/investments/securities.

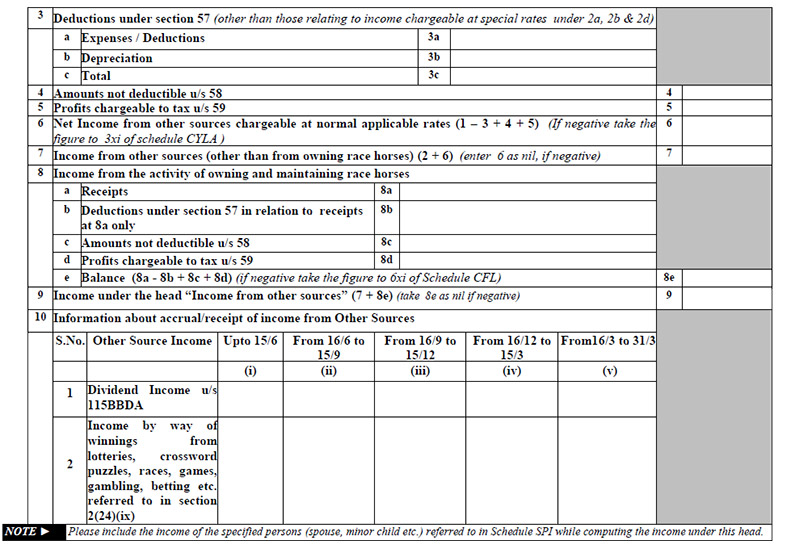

Income from winning, lottery, gambling, horse race under the head- income from other sources. Taxpayers who earn agricultural income above Rs.5000/. ITR 2 can be filed by the individuals or HUFs having income from the following sources:Īssessee having total income more than Rs.

Who is Eligible to File ITR-02 for AY 2021-22? This ITR is for individuals and Hindu Undivided Family having source of income from salary/pension, multiple house properties, capital gains, other sources, foreign assets/income other than business income.

0 kommentar(er)

0 kommentar(er)